Award-winning PDF software

How to prepare Fannie Mae Bpo

About Fannie Mae Bpo

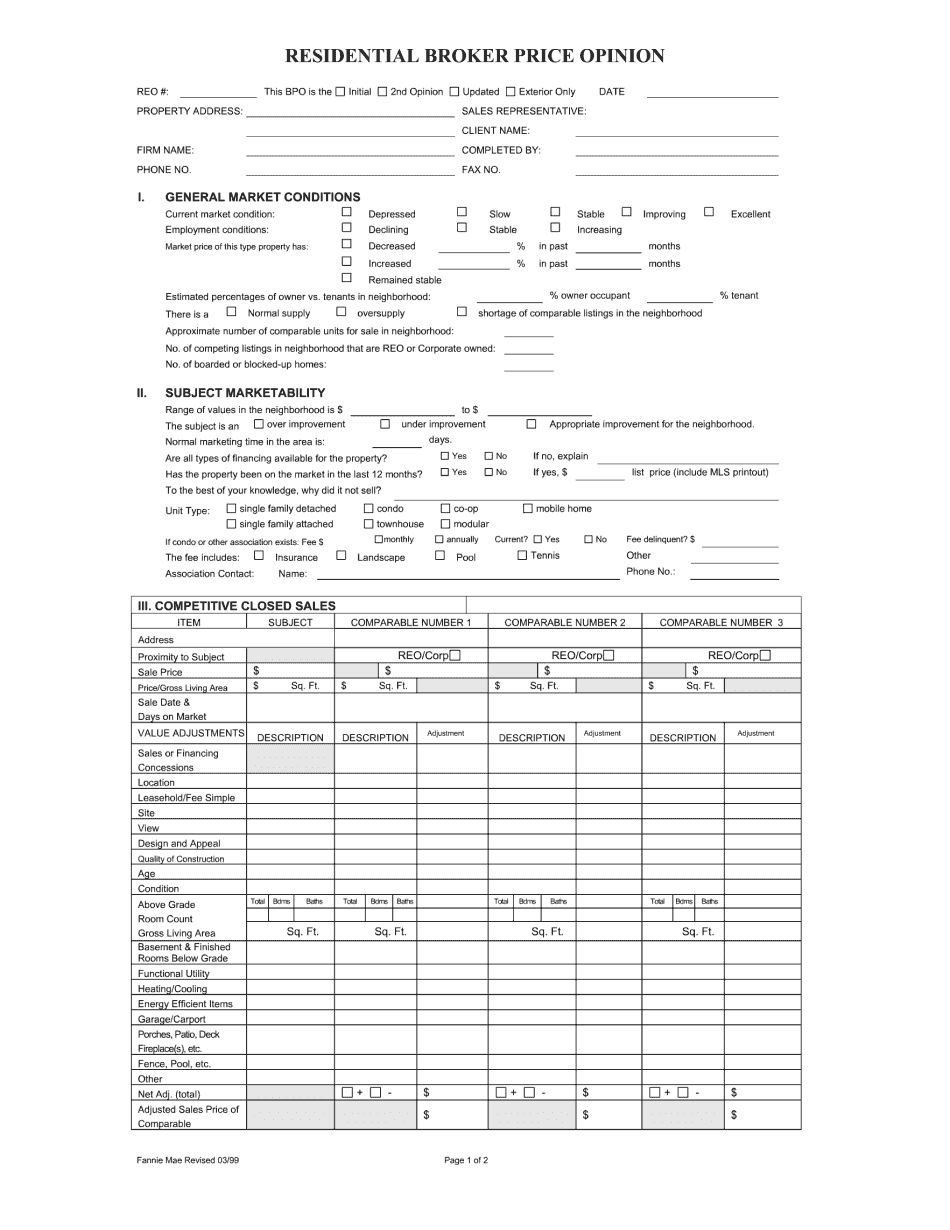

Fannie Mae BPO (Broker Price Opinion) is an evaluation of a property's value conducted by a licensed real estate broker or agent on behalf of Fannie Mae, a government-sponsored enterprise that provides liquidity to the US housing market by purchasing and guaranteeing mortgages. This evaluation is used to determine the current market value of a property and to assist Fannie Mae in making informed decisions about loan modifications, foreclosures, and other real estate transactions. Fannie Mae BPOs are typically ordered by banks, loan servicing companies, and other financial institutions that have a stake in a property. Lenders may require a BPO when a borrower defaults on their mortgage to determine the current market value of the property. Real estate investors may also use BPOs to evaluate potential investment opportunities. Fannie Mae BPOs can provide a quick and cost-effective alternative to traditional appraisals, which can be more time-consuming and expensive.

Online technologies enable you to organize your document administration and strengthen the efficiency of the workflow. Follow the quick information in order to fill out Fannie Mae Bpo, stay away from mistakes and furnish it in a timely way:

How to complete a blank Brokers Price Opinion Form PDF?

-

On the website containing the form, press Start Now and pass towards the editor.

-

Use the clues to fill out the relevant fields.

-

Include your personal details and contact details.

-

Make certain that you enter suitable information and numbers in proper fields.

-

Carefully check out the content in the blank so as grammar and spelling.

-

Refer to Help section when you have any issues or address our Support staff.

-

Put an electronic signature on your Fannie Mae Bpo printable while using the help of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the prepared by means of email or fax, print it out or save on your device.

PDF editor will allow you to make modifications towards your Fannie Mae Bpo Fill Online from any internet connected device, personalize it in line with your requirements, sign it electronically and distribute in several means.