Hi, this is Karen Dice, publisher of Mortgage Currency Magazine. In early 2013, Fannie revamped their "other income" underwriting rules to be more detailed, in order to help loan officers, processors, and underwriters understand the types of documentation they're looking for. Now, over one-third of the questions subscribers ask us is how to count other income for Fannie loans. So, I've asked our Fannie and Freddie expert, Lloyd Rutherford, to review the updated rules for you. If you were to read Fannie's underwriting guide, they have them alphabetized. For the sake of time, this class will cover income types from letter A to letter M. You'll find a second online class on the same topic with income types from letter N to letter Z. If you're a subscriber and you have a specific question, remember that as part of your subscription, you have access to the help desk. It's also helpful to provide us with as much detail as possible so we can help you get more of your loans approved. Now, I'd like to turn this class over to Lloyd Rutherford, who will review Fannie Mae income types starting with alimony and ending with mortgage differential payments. Thanks, Karen, for the introduction. I do want to say before we get started that these slides are broken down into two sessions per slide. On the left-hand side is the income guidance that Fannie Mae has provided for us as of May 2014, and on the right-hand side of the slide is the talking point that we can focus on during the conversation. Also, the most important tip I can give subscribers today is this: The reason Fannie Mae updated their guidelines is for Fannie Mae's new system, TUA 9.1. This new system will accommodate a more descriptive type of other...

Award-winning PDF software

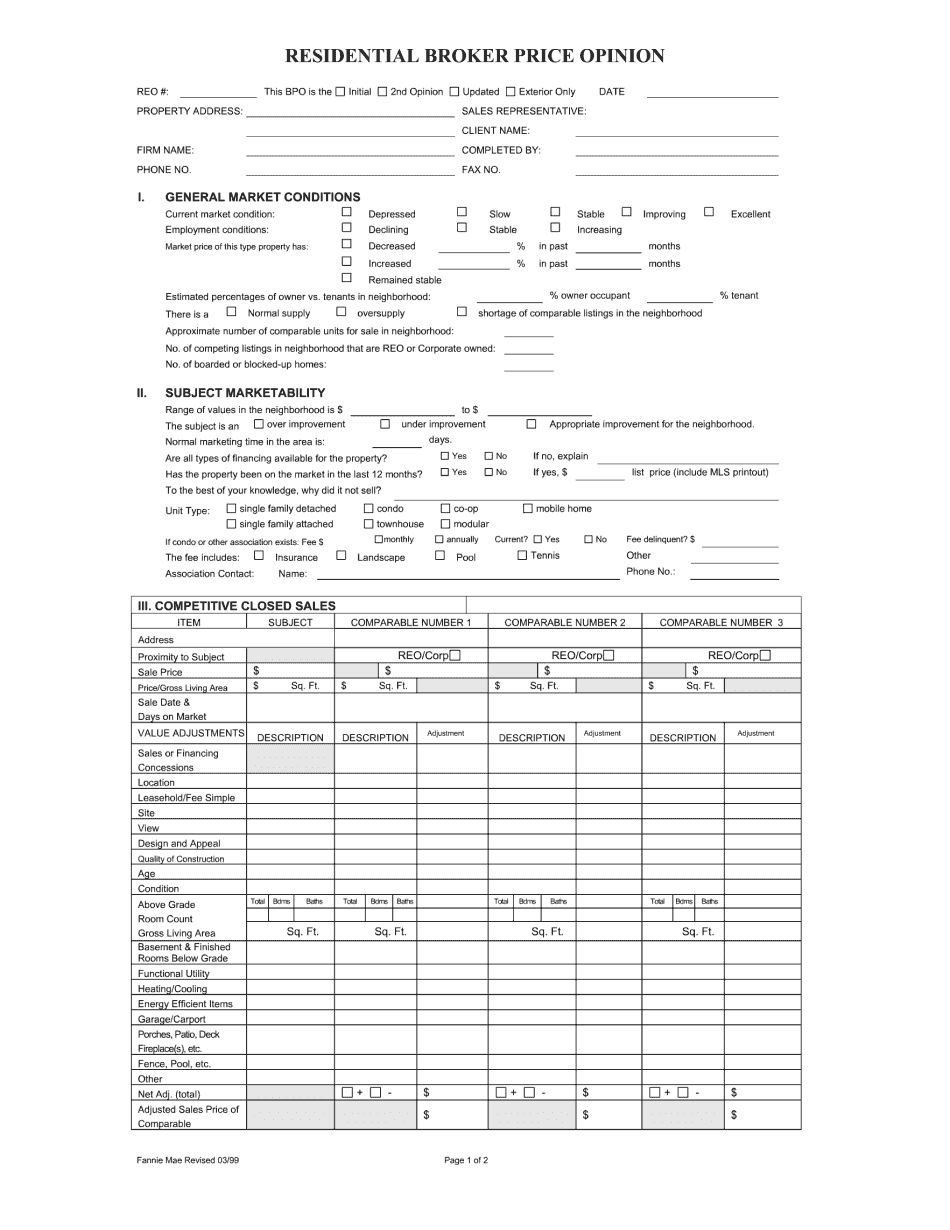

Fannie Mae Bpo Form: What You Should Know

Select Customer > Customer login Enter your Fannie Mae ID number and Customer Code. If you don't understand what a customer code is, we suggest you read Fannie Mae's FAQ s for more information on Customer IDs. Fill out & sign online | Chub Fannie Mae has 3 main types of residential broker reports. Home Value: Residential Broker Report is an initial analysis of property values. Price: Residential Broker Report is an initial analysis of sales prices. Sales: Residential Broker Report is an initial analysis of sales.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie Mae Bpo