Hello, this month's everything guide update provides details on how we are simplifying servicing for our customers. - Our first update aligns our policies with the recent changes made by the CFPB to the mortgage servicing rules under RESPA Antilla. - This update will generally take effect in October 2017, with exceptions as permitted by applicable law. - The specific changes can be found in the servicing guide announcement and the May version of the servicing guide reflects these changes. - We have also provided clearer guidance on the evaluation of escrow waiver requests to encourage objective and consistent decisions. - We have listened to our customers and created a simple review process that utilizes readily available servicing data, such as the borrower's payment history and original appraised value, without increasing the risk of financial loss. - Our servicing guide has been updated to allow us to be more responsive to transfer requests, while being mindful of the difference between servicing and sub-servicing transfers, sale date, and proposed servicing transfer date. - Additionally, the $500 processing fee for form 629 submissions has been eliminated. - The document custodian reporting requirements in Section A of form 629 have also been updated, and we encourage you to review the form for additional details. - For agreements with government insurers and guarantors, we now require written approval before participating in any pilot programs or entering into your grants fitment program maximum claim recovery. - This requirement helps to ensure that you are not put at risk for a future request for indemnification. - For more information on these and other servicing policy updates, please refer to the RMA servicing guide. - Thank you to our servicing partners.

Award-winning PDF software

Fannie mae servicing Form: What You Should Know

Selling and Servicing Guide Communications and Forms If you are not yet a Fannie Mae Service, click here to learn more about the process to become one. Fannie Mae Servicing Guide · Guide Communications & Forms. Access forms, announcements, lender letters, notices, and more, to stay current on our selling and servicing policies. Email subscription Fannie Mae Servicing Guide If you are not yet a Fannie Mae Service, click here to learn more about the process to become one. Servicing Guide · Guide Communications & Forms. Access forms, announcements, lender letters, notices, and more, to stay current on our selling and servicing policies. Email subscription Fannie Mae Servicing Guide If you are not yet a Fannie Mae Service, click here to learn more about the process to become one. Servicing Guide · Guide Communications & Forms. Selling and Servicing Guide Communications and Forms If you are not yet a Fannie Mae Service, click here to learn more about the process to become one. Servicing Guide · Guide Communications & Forms. Fannie Mae Servicing Guide — For a comprehensive list of resources such as access forms, announcements, lender letters, notices, and more. Visit Selling and Servicing Guide Communications and Forms. Email Fannie Mae Servicing Guide Email Marketing Services Program If you are a small business or business, and you want your company's messages sent to a worldwide audience of customers and potential customers, Fannie Mae is the right answer for you. Click here to learn more. Email Marketing Resources Fannie Mae is the world's largest mortgage originator. Fannie Mae has been investing in technologies and services to serve our customers in ways only possible through today's Internet — and today's clients, customers, and prospects. We use the Internet in a highly interactive, dynamic environment, with a huge customer base. Our team is built to support you in this endeavor: online, online, by phone, and over the phone. Our service agents have expertise at the cutting edge of the industry, and we also utilize tools such as our customer portal, E-Learning, and a full suite of web-based marketing tools and channels to reach our customers. We also use an advanced customer relationship management (CRM) technology platform to build and manage relationships between our customers and their housing.

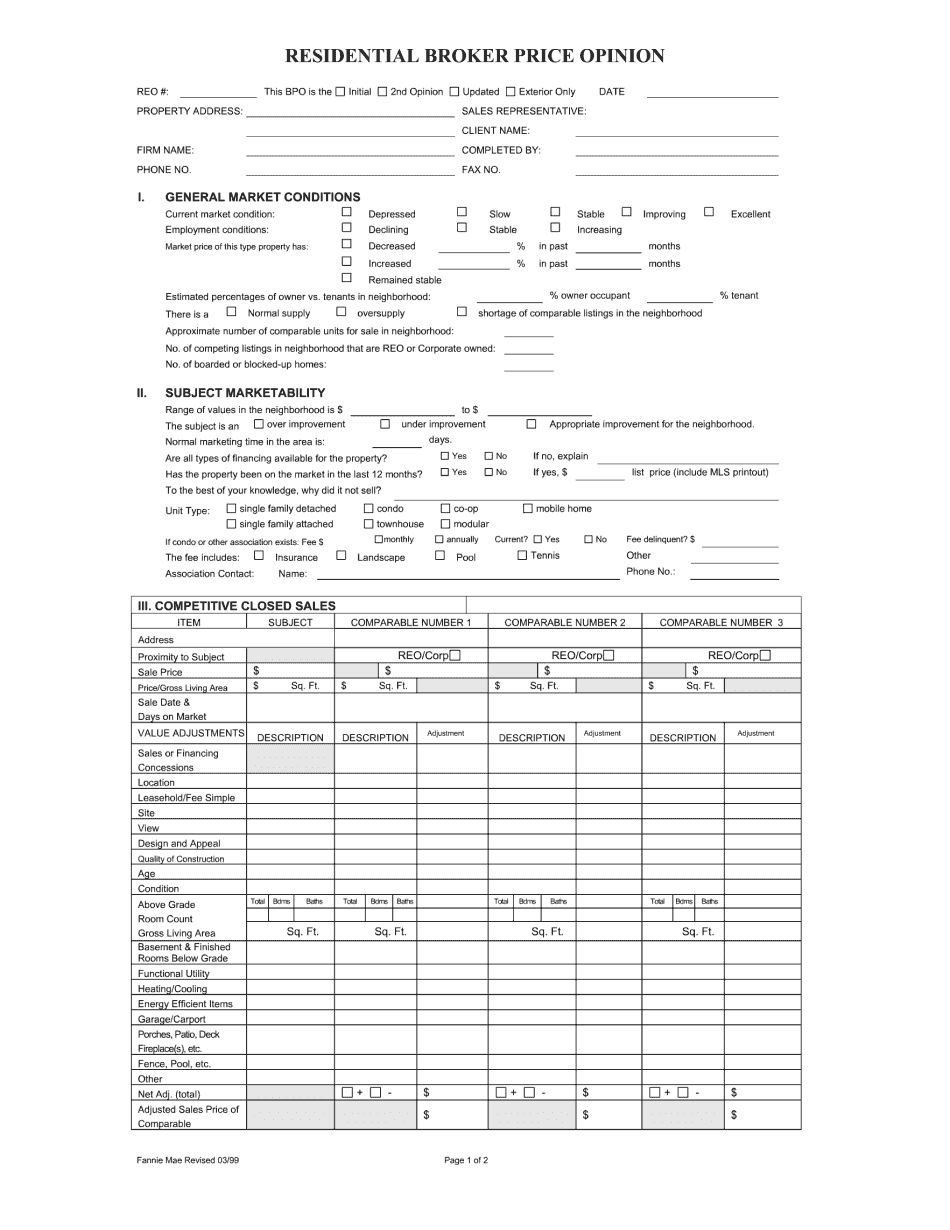

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie mae servicing