Hi, this is Todd Baker, your certified mortgage lender. Today, we're going to talk about the notice of appraised value for property taxes. Each year, your county's appraisal district assesses the value of your property. You can find information about this procedure on your county's website, such as Colin, Taryn, Denton, or Grayson County. Larger counties may have more detailed websites. The process begins after the taxes are filed, and the appraisal district analyzes market data electronically similar to Zillow, but more robustly. They also conduct fieldwork to determine the valuation of your property. This valuation is sent to you in a form called the notice of appraised value, which you receive in April. It's crucial for homeowners to carefully review this notice when they receive it. Many people overlook these notices, but it's important to pay attention to them. I will discuss what to look for, what to be aware of, and how to protest if the county assesses your property value too high. In certain areas, property values can increase from year to year based on market demand and appreciation. You want to ensure that the county's assessment aligns with or is below the market value. If it's significantly higher, you have the right to protest and potentially lower your property taxes. Additionally, you should verify if you have a homestead exemption or other exemptions and make sure they are included on the form. Now, let's delve deeper into this topic. I have brought in a couple of forms to show you. Firstly, this is what the 2019 notice of appraised value form looks like. In the table, you will see the improvements and market value of the land. The form will tally up the total appraised value, which in this example is $569,658. However, this year it has decreased...

Award-winning PDF software

1004p Appraisal Form: What You Should Know

Fannie Mae will be modifying its URAL to incorporate forms such as 1004 and 1004P, as well as a new electronic process called Hybrid 1004 desktop appraisal. To accommodate these alternative forms, the URAL will be renamed to the 1004 Desktop Form. Fannie Mae Will Add New 'Hybrid' or '1004 Desktop' Forms The 1004 Desktop Form is being added to the URAL. Fannie Mae Plans to Expand Its Hybrid Evaluator and Desktop Evaluator Process Fannie Mae plans to make a series of changes to its hybrid appraiser process. First, the changes will be made to all appraisal procedures in the state. A pilot program in a few other states will determine whether the changes have any effect. In the meantime, Fannie Mae will expand its use of a more advanced version of the 1004 Desktop Form. New and Improved 1004 Desktop Form and 1004Hybrid Form Fannie Mae plans to use the 1004 Desktop Form (and related form categories) for both home sales and open houses. Fannie Mae, the State of North Carolina and the State of Massachusetts have adopted the 1004 Desktop Form. To qualify, the property must be: · located in North Carolina; and · located in Massachusetts. 1004 Desktop Examination Forms and the 1004 Desktop Form for Sales-Only Properties in North Carolina The 1004 desktop form includes the following exam formats: A2 and A2X (on-site exam and interview). 1004 Desktop Form and 1004Hybrid Forms for Sales- only Properties in California The 1004 desktop form includes the following exam formats: N7 (on-site exam and interview). 1004 Desktop Exam Formats and 1004 Desktop Form for Sales-only Properties in Florida and New York The 1004 Desktop Form includes the following exam formats: A2 and A2X (on-site exam and interview). 1004 Desktop Exam Formats and 1004 Desktop Form for Sales- only Properties in Georgia and New Jersey The 1004 Desktop Form includes the following exam formats: N7 (on-site exam and interview). 1004 Desktop Exam Formats and 1004 Desktop Form for Sales-only Properties in Nevada and Ohio The 1004 Desktop Form includes the following exam formats: A2 and A2X (on-site exam and interview). 1004 Desktop E.O.

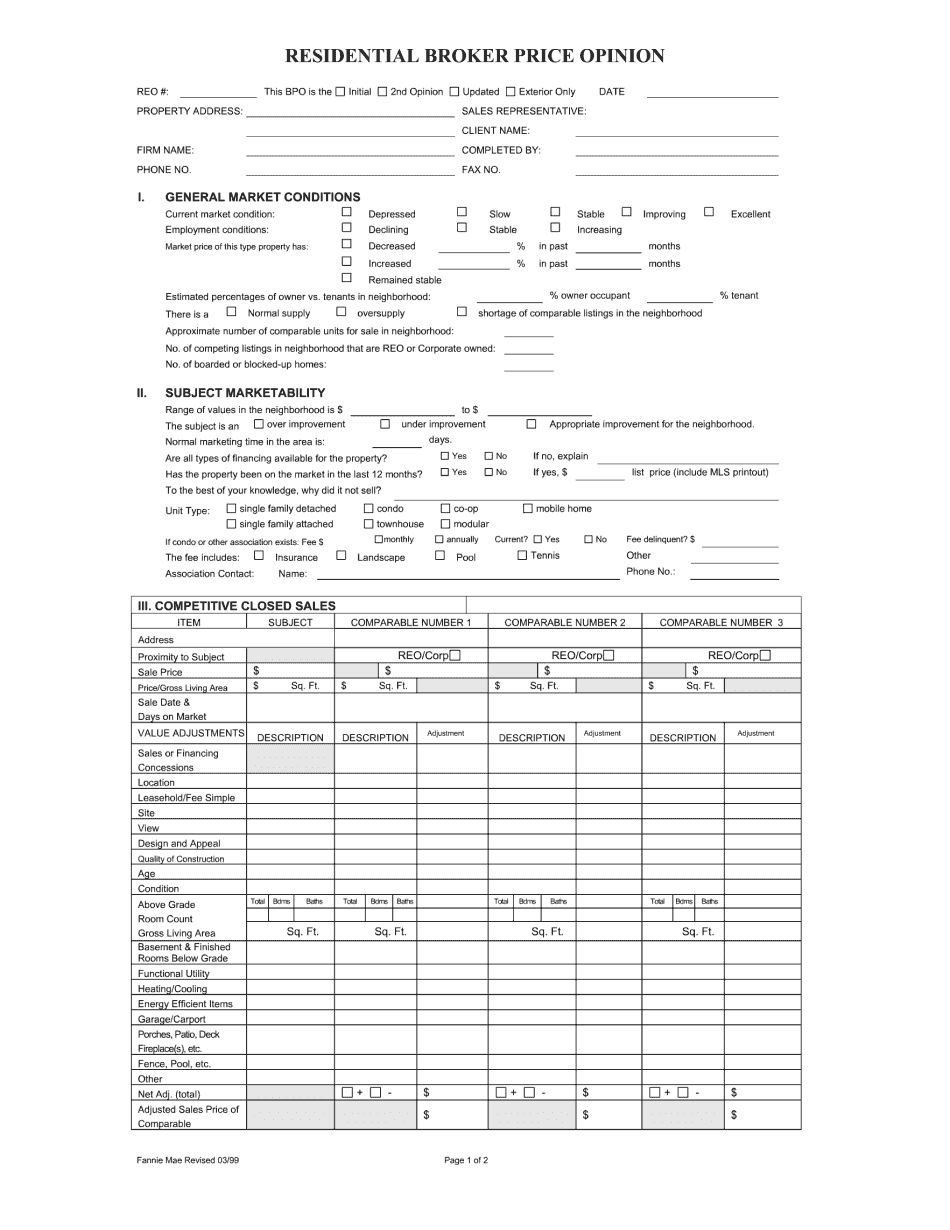

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1004p Appraisal form