Hi, I'm Mike, the Managing Partner of uber writer. Today's video blog is part two of our Fannie Mae Day One Certainty program. In the last weekend's video blog, we discussed what the program is about. Basically, as a mortgage business, we are always looking for ways to speed up loan processing, improve quality, reduce mistakes, and attract more borrowers. The Fannie Mae Day One Certainty program helps us achieve all these goals. It is like a gift from Fannie Mae to make us more efficient and provide better service to borrowers. Now, as promised, let's talk about the collateral piece of the Fannie Mae Day One Certainty program. We have all been familiar with property inspection waivers (PIWs) for years. If a borrower had a good credit score, lower loan-to-value ratio, and ample reserves, they could get a PIW, which waived the need for a property inspection. This was the only way to get any relief on the warranty. As an underwriter, I can tell you that income and value are the hardest aspects to assess. Appraisals, in particular, are like artwork. There is no exact number, and different appraisers may have different opinions of value for the same property. Our job as underwriters is to ensure that the opinion of value in the appraisal is reasonable and justified. We don't want a situation where the appraiser says the property is worth $200,000, but all the comparable properties sold for around $100,000. On the other hand, we also don't want an appraiser using vastly different comparable properties to justify a value of $2 million for a property. Despite the subjectivity of appraisals, they have always been an integral part of the underwriting process. However, with the Fannie Mae Day One Certainty program, we now have enhanced PIW benefits. We all know that...

Award-winning PDF software

Easy valuation fannie mae Form: What You Should Know

Fannie Mae Form 1006 Commercial Real Estate/Commercial Mortgage Salesperson Review: Part II. Form 1007 Commercial Real Estate/Commercial Mortgage Review: Part III. Form 1008 Residential Property Appraisal Review: Part II. Form 1017.00 Residential Property Appraisal Review: Part III. Form 1020-5.01 Commercial Residential Appraisal Report. Form 08 Residential Appraisal Reports, Form 05, Form 1036.50, 1004, and 1003.00 Appraisal Information Report. Form 05, 1004, and 1003.00 Appraisal Information Releases. Form Appraisal Information Report. Form 1017.00–5.01 The Residential Property Appraisal Review Form in Fannie Mae's Uniform Residential Appraisal Report is used to assess a property or to Revaluate the value of a residential unit. Form 1008–5.01 This is a report form, for commercial, residential, or plan of subdivision (SOD) transactions, that provides information about the value of a real property or dwelling, including an accessory unit. The Fannie Mae forms and tables on this website include the standard Appraisal Report, a residential property appraisal report, and a commercial property appraisal report. The first is required by the Regulation E Home Price Index Disclosure Act . The second is required under Fannie Mae's mortgage-backed securities disclosure policy. The Standard Appraisal Reports contain detailed information about the property and its performance, including a price-to-rent ratio; market-value gain, which is a measurement of an owner-occupant's ability to get a new mortgage within one year of closing plus 2% of its principal balance, minus any amount of mortgage insurance premium paid; and a residual cash flow assessment. Appraisal report data also include income and expense information. They also disclose a borrower's credit score, if any, by loan type and by state. Appraisal reports have the same limitations as Fannie Mae's Home Mortgage Disclosure Statement (Form 1004), the Mortgage Information Statement (Form 1005), the Mortgage-Backed Securities Disclosure Act Form (Form 1004b), and the Nonprofit Home Mortgage Disclosure Act form (Form 5304).

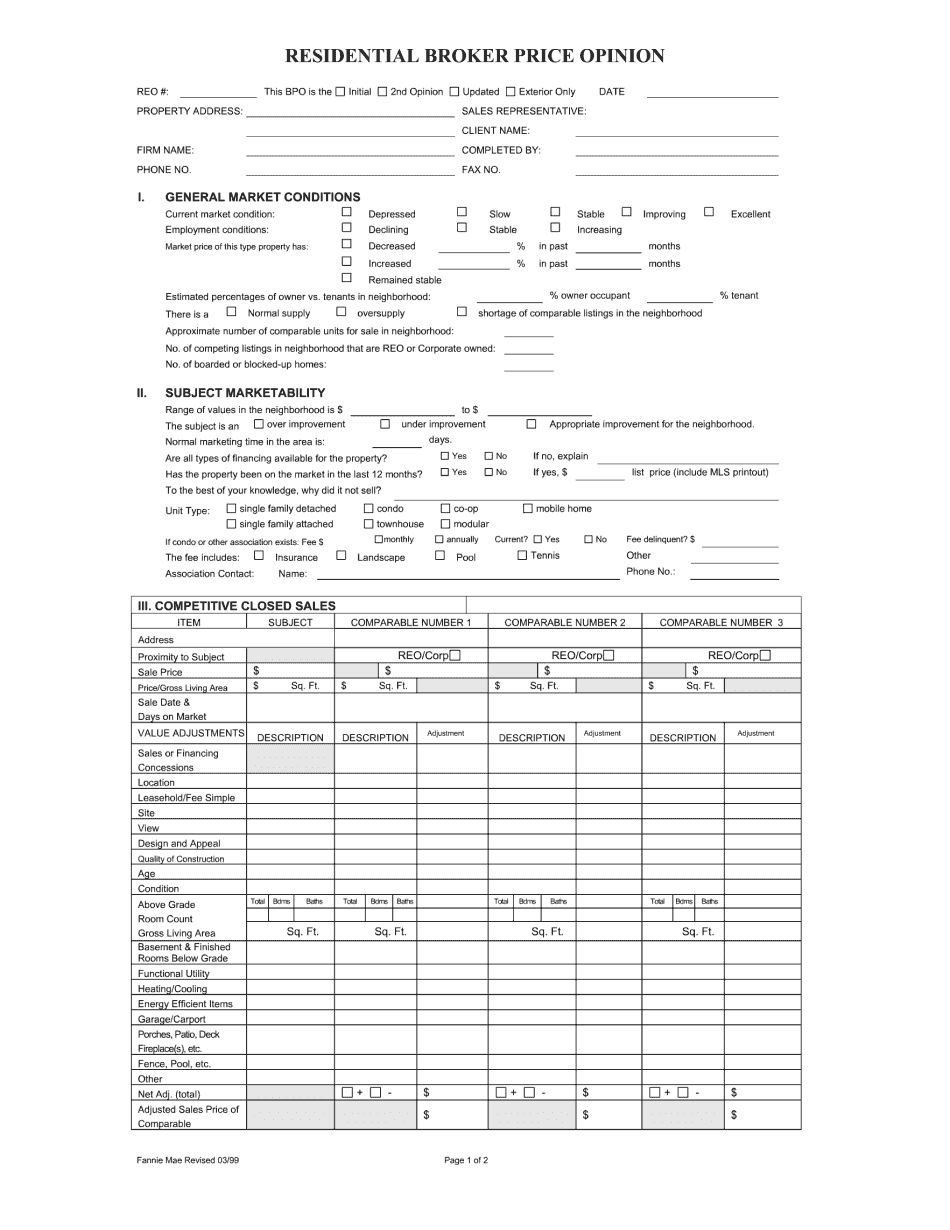

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Easy valuation fannie mae