Music, here's a great and radical idea: everyone in America should have access to safe and affordable housing. That's a vision I know many people share, and it's a core part of the mission here at Fannie Mae. However, the fact is that the average share of Americans' income going towards housing expenses is on the rise. For many, this percentage is so high that they have very little money remaining for necessities like food, transportation, and maintenance, which could lead to an unsafe home. We all have a duty to serve and address these concerns as best we can. I use the phrase "duty to serve" on purpose because it's the name of a job given to us by Congress. Our focus is on three specific markets that relate to the challenge of creating safe and affordable homes. These areas include manufactured housing, affordable preservation, and rural housing. I am absolutely thrilled to take on these challenges alongside my colleagues here at Fannie Mae. Our company is uniquely positioned to tackle these issues. One way to think of Fannie Mae and the financial system is as a way of building paths between global investors and those who need to borrow money, such as individuals who want to buy homes. While you and I go to our local lender to get a mortgage, Fannie Mae and the financial system exist to create a connection that makes it cheaper and easier for people to buy homes and obtain mortgages. However, sometimes making that connection is not as easy, especially in the three areas we are working on. We see ourselves as key path builders and partners. We are uniquely positioned to bring the right parties together and find innovative solutions to make housing more affordable for everyone. Our job is to provide investors with...

Award-winning PDF software

Fannie mae 2025 9 Form: What You Should Know

The table below shows net interest income growth in various years for. (Published 11/26/22); Mortgage Business | Mortgage Securitization. Fannie Mae First Quarter 2025 Form 10-Q. 10. Selling Guide — Fannie Mae Jan 25, 2025 – 2025 and related notes to the consolidated financial statements. Business | Mortgage securitization. Fannie Mae First Quarter 2025 Form 10-Q. 9. See Note 5 for additional information on our net interest income, average amounts in loans, and related yields earned on Mortgage Business and Mortgage Securitization. Selling Guide — Fannie Mae Jan 25, 2025 – 2025 and related notes to the consolidated financial statements. Business | Mortgage securitization. Fannie Mae First Quarter 2025 Form 10-Q. 9. See Note 5 for additional information on our net interest income, average amounts in loans, and related yields earned on Mortgage Business and Mortgage Securitization. Gain From Sales and Servicing Guides The following guides use the word “sale” in some form in describing activities. Jan 10, 2025 – 2018. Business | Mortgage securitization. Fannie Mae Gain From Sales and Servicing Guides. 10. Gain From Sales & Servicing Guides and Loan Document Requirements The following guides use the word “servicing” or “servicing” in some form in describing activities. Jan 10, 2025 – 2018. Business | Mortgage securitization. Fannie Mae Gain From Sales and Servicing Guides and Loan Document Requirements. 11. Gain From Sale & Servicing Guides Fannie Mae uses “Gain from Sales and Servicing Guides” in accordance with applicable provisions of the Federal Acquisition Regulation. In accordance with this release, “Gain from Sales and Servicing Guides” refers to the following guides: Gain From Sales & Servicing Guides Jan 10, 2025 — Fannie Mae Gain From Sale and Servicing Guides. 8. (Published 11/28/22). This release does not change information previously released in the preceding reports or the prior annual report. However, information may be changed as a result of subsequent changes in our management. Mortgage Capital Guidelines Overview A review of Fannie Mae's mortgage capital guidelines Fannie Mae Mortgage Capital Guidelines Overview. 7. See also Chapter 2 of this release.

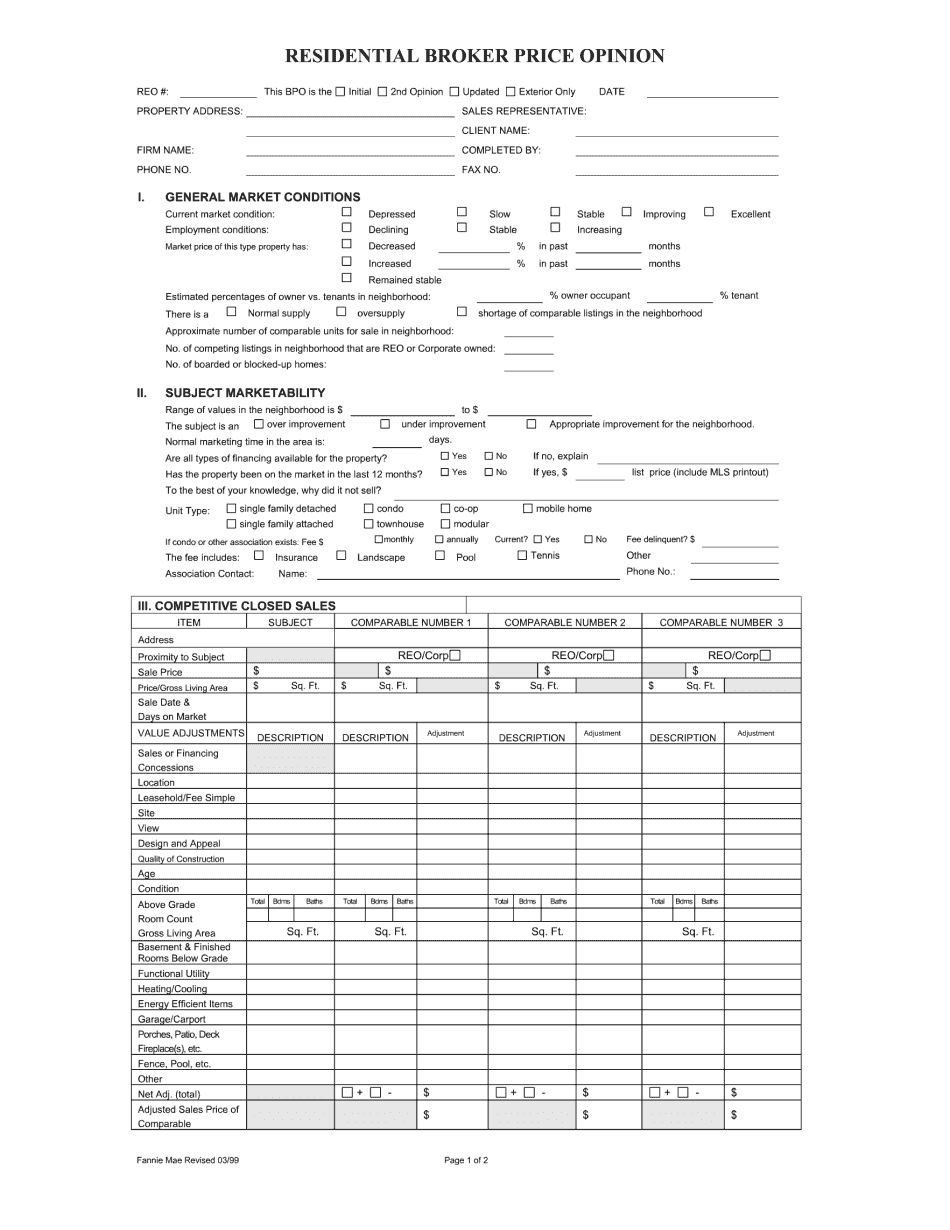

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie mae 2025 9