Award-winning PDF software

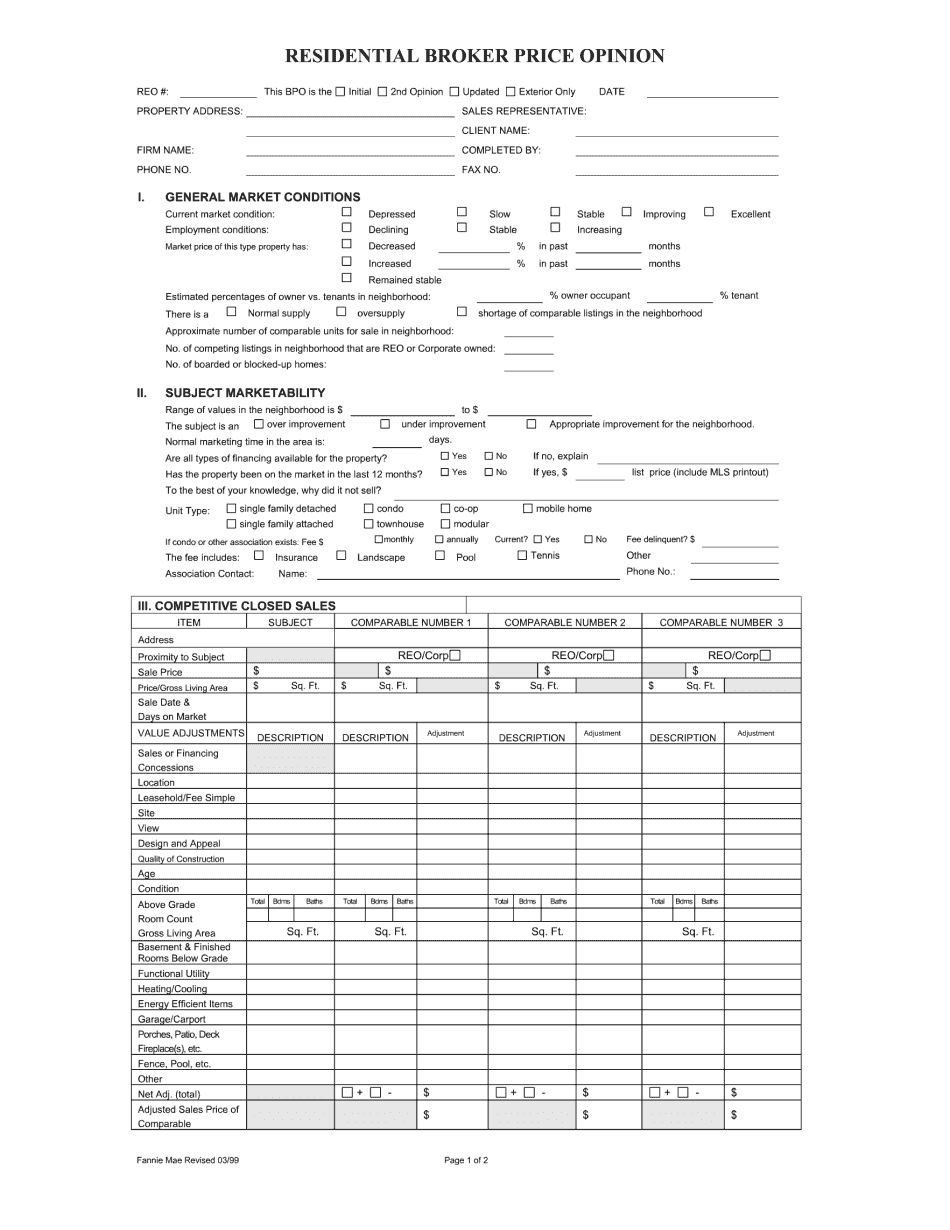

Fannie mae business Form: What You Should Know

What is the Seller's responsibility for the company and its businesses? · Identifies and identifies the entity's current and intended corporate officer(s) · Identifies the applicant's current and intended CEO(s) · Identifies the applicant's intended treasurer/CFO/CMO /CFO(s) · Verifies that applicant is the owner of the business · Completes the appropriate business licenses and registrations · If owner, submits appropriate business income tax returns and/or business tax withholding records · Completes and receives appropriate approval, approval in proper form, and documents What if the applicant has a partner? · Submits appropriate agreements and/or documents to demonstrate that the partnership is operating at arm's length · Verifies that the partnership has appropriate filings in any state, city or county, or on any securities clearing agency. What if the applicant is not a partnership? · Does not have sufficient capital to file an income tax return, or to make tax withholding filings, or to meet the Fannie Mae sales and service requirements; in this case, a non-federal Fannie Mae agent will be contacted; and the company may be required to file an application with the U.S. Treasury Department. (Note that certain types of LCS fall under this category.) What is the Seller's responsibility for the company and its businesses? · Identifies and identifies the entity's current and intended corporate officer(s) · Identifies the applicant's current and intended CEO(s) · Identifies the applicant's intended treasurer/CFO(s) · Completes the appropriate business licenses and registrations · If owner, submits appropriate business income tax returns and/or business tax withholding records · Completes and receive appropriate approval, approval in proper form, and documents How do I know if it is my property? · Determine who is the primary owner by asking the borrower for proof of ownership · Determine the legal ownership by determining the legal entity's filing and/or registration status · Verifies that the business does not have a registered agent in any state, city or county and is not required to file an income tax return, or meet any tax-related requirements · Completes and receive appropriate approval, approval in proper form, and documents and any IRS Form 1065, Schedule K-1 Form 1003.2 — Qualified Mortgage Purchase Agreement.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.