Award-winning PDF software

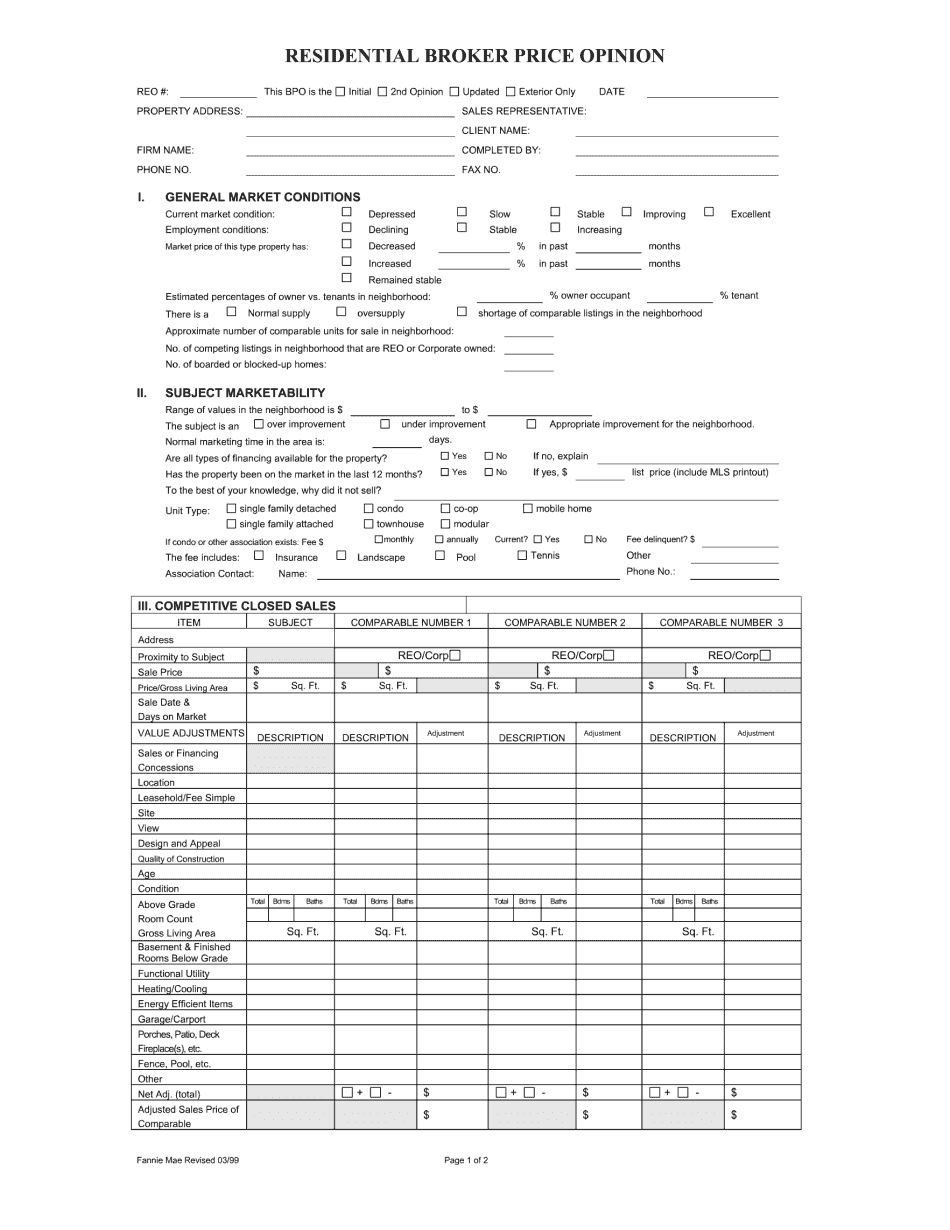

Fannie mae substantial improvements Form: What You Should Know

Includes only the owner's information when appraiser is a private person with no business relationship. The appraiser will take the owner's name and address. The appraiser must file these documents separately from other documents required by all owners of property that will be appraised. APPENDIX E: GUIDE TO HOME PROPERTY VALUATION FOR FEDERAL REVENUE TAX PURPOSES The following is a guide on how to properly value the home for federal tax purposes. This document is meant ONLY to help owners of homes to properly calculate the home's value for federal tax purposes. This document is not intended to offer tax advice. The purpose of the Guide is to guide and provide information on how to properly value a property. This guide is not intended to provide tax advice. We suggest that you consult a professional tax accountant, tax compliance counselor, or real estate tax advisor in your jurisdiction for guidance in all other aspects of your home's value. It is also the responsibility of the owners to ensure that the value reported is accurate and up-dated in its current form and form and manner. A note of the federal tax law's requirement to obtain a property appraisal (Tax Code Section 1245(a)), as well as the requirements for obtaining a qualified appraisal, is included at the end of this Guide with some brief explanations. This Guide is intended to assist owners in estimating value. It does not replace or replace the owners' responsibility for doing their own business and/or conducting their own appraisals, or any other work that requires appraisals. The appraiser will attempt to determine value by obtaining an accurate representation of: The condition of the property as described in the Plan of subdivision. The condition of any improvements. If any significant changes, additions, or additions to the property were made to the property during the last 100 years. Whether the property is the subject of a recent construction or an extension of a recent construction. Whether the property is in need of major repair or replacement. If the property is a vacation home. These will be considered by your appraiser to be major repairs and major extensions, as the basis for the appraisal. If the property is used as a residence for more than half the year. If a property is vacant for more than 30 days in any year. The owner is responsible for ensuring that the appraisal properly values their property.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.