Welcome to Net Directors Mortgage Banking Data Exchange. Here's a quick preview of how our cloud-based data exchange can help you as a default servicing attorney or vendor. It can save you time and money. Our data exchange ecosystem for mortgage banking includes many participants such as attorneys, trustees, mortgage loan servicers, process servers, publications, title companies, and more. All of these participants have a single connection to Net Director. So, how do we do it? We start with a secure cloud-based service. You can have peace of mind knowing that the information you exchange is protected and compliant. Next, we integrate each participant's system into our centralized data exchange hub. Finally, you can connect to our data exchange through a single integration and data mapping. This allows you to start exchanging data and documents in a bi-directional and real-time manner with any participant in the ecosystem. Your data integrity is maintained through one standard data mapping. Net Director will also help you reduce or eliminate time-consuming data entry and mishaps. It will reduce the IT resources needed to develop and maintain multiple direct interfaces, and increase your capacity to handle more volume. The net result is that you save valuable time and resources, which means you can increase your bottom line. With Net Director, you're in good hands. You'll have a single source of support for all your trading partners, as well as a dedicated integration analyst to help you every step of the way. So, what are you waiting for? Contact us today to start integrating.

Award-winning PDF software

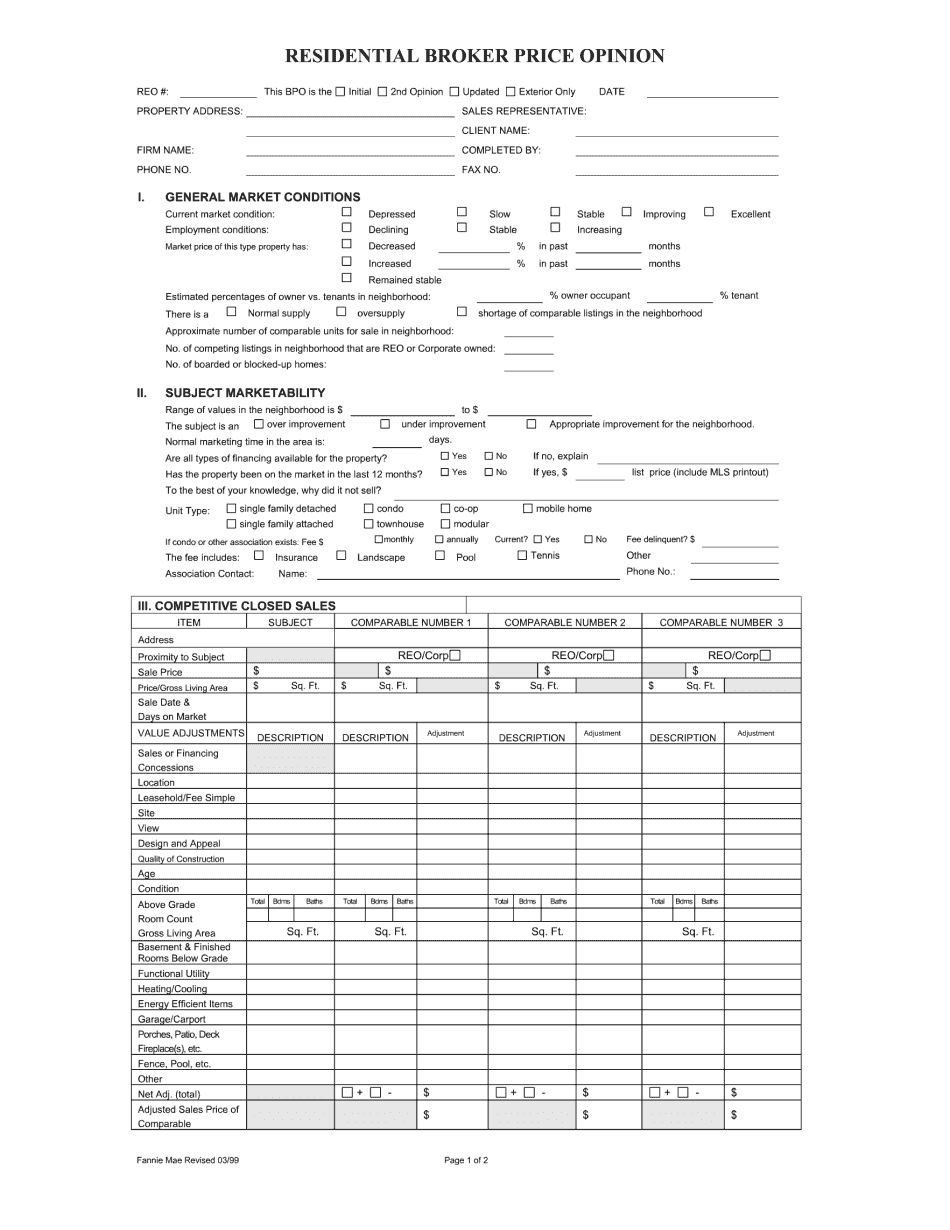

Fannie mae's servicing solutions system Form: What You Should Know

Fannie Mae Home Sales and Servicing Guide: Sales Orders — Fannie Mae's sales force will assist you in selecting home sales associates, preparing the Property Purchase Agreement (PPA) and submitting it for our records to fulfill your Home Sales and servicing Fannie Mae Servicing and Sales Processes — Fannie Mae has specific and unique requirements when Fannie Mae Contractual Agreements | Contractual Service Terms | Mortgage Service Contract | Service Contract and Servicing Agreement | Loan and Servicing Schedule and Loan Performance Index These agreements establish how Fannie Mae provides its mortgage servicing and sales services, and the terms and conditions on which we will provide We help your home buyers, sellers, and other Fannie Mae clients with all types of home transactions through our experience and expertise. Here are some examples of the types of applications we may help you with: A home for sale (sales) Loan modification (loan and title) Residential mortgage loan modifications Newspaper advertising Servicing and sales of new single family homes and multi-family rental properties Property tax, inspection and title search Property appraisal (for single-family homes) Sales of real estate by Fannie Mae's Mortgage Repayments Schedule and Repayment Plan Repayment of all principal and interest will be assessed by Fannie Mae based upon the current market interest rate. There is no payment deadline for defaulted payments. Interest payments are considered due on the Fannie Mae Mortgage Loan Servicing Guide • Included in the servicing and property maintenance programs is an annual review of your service performance and an inspection of your home for Property Inspection — Fannie Mae Our Mortgage Inspection service can help your home buyer, seller and Fannie Mae homeowners to inspect and ensure the health, safety and functioning of their home for sale, Fannie Mae Mortgage Service Contract — Fannie Mae If you wish to purchase a single or multiple family home, Fannie Mae can assist you with the requirements to sell or finance a new home under its Mortgage Service Contract. Home Sellers and Mortgage Service Contract Process — Home buyers can use this service to get more information about your home and determine your value. The Seller will also provide you with the details on your financing requirements.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie mae's servicing solutions system