Hello, before we talk about our November servicing guide update, I'd like to highlight our most recent winter letter regarding servicing policies for communities impacted by recent hurricanes. This Lindner letter, released on November 2nd, provides new servicing requirements for borrowers impacted by a FEMA declared disaster for individual assistance, including new modification flexibilities related to insured lost draft disbursements and more. It joins several other hurricane-related lender letters, all of which can be found on our website. Alright, let's move on to this month's update, which continues to support our commitment to simplifying servicing. We're providing clearer, simpler, and more consistent requirements for transfers of ownership, releases of liability, and assumptions. First, we are removing owner occupancy requirements for transfers of ownership that are exempt from enforcement of the duan transfer clause. Exemptions will continue to apply to property transfers to a borrower's relative, including a spouse, child, parent, sibling, grandparent, or grandchild, and to an inter vivos trust. We will now allow transfers of ownership to limited liability companies when certain requirements are met. These new exemptions apply to loans acquired or pooled in MBS on or after June 1st, 2016. And for even greater certainty, for a release of liability, we are now allowing servicers to use desktop underwriter. The power of DU's comprehensive risk assessment can help servicers determine if a transfer's credit and financial capacity are acceptable to release the borrower from liability. We are also delegating to servicers the ability to decision a transfer of ownership from an assumption modification for transfers eligible under the duan transfer exemption. We've restructured and updated the servicing guide. These changes will really benefit servicers and make it easier to do business for these transactions. We think servicers will be excited to incorporate them into their processes and procedures as...

Award-winning PDF software

Fannie mae servicing guide Form: What You Should Know

For borrowers who may have filed for bankruptcy, here are the details about the information they have been required to share during the bankruptcy process with the service as part of the terms of their loan Guidance about how the Trustee will assess borrowers. Servicing Guide · Loan Information Guide Servicing Guide to help Fannie Mae service and manage your mortgages. Servicing Guide to help Fannie Mae help you keep your homeownership opportunities open. Servicing Guide to help Fannie Mae help you keep your loans current, safe and current and reduce the costs of servicing your loans. Servicing Guide to help Fannie Mae help you keep your loans current, safe and current and reduce the cost of servicing your loans. Servicing Guide to help Fannie Mae protect your investments. Servicing Guide to help Fannie Mae monitor your property for risks and protect your real estate investment. Servicing Guide to help Fannie Mae provide you with accurate information. Servicing Guide to help Fannie Mae provide you with accurate information to determine your eligibility for certain programs. Servicing Guide to help Fannie Mae provide you with accurate information to determine your eligibility for certain programs, including, but not limited to, FHA loans (Federal Housing Administration), Title I (Section 8) loans on primary residences (pre-1983 only home purchases if home sold within 30 days of acquisition), and Veterans Benefits Administration loans (Veterans Benefits Administration and/or military/disabled). Servicing Guide to help Fannie Mae provide you with accurate information to determine your eligibility for certain programs, including FHA loans (Federal Housing Administration) or Veterans Benefits Administration (VA) loans (VA) or loans that do not require a Fannie Mae loan qualification factor (VA or VBA) to receive benefit payments. Servicing Guide to help Fannie Mae provide you with accurate information to determine whether you require a Fannie Mae loan qualification factor (VA or VBA). Servicing Guide to help Fannie Mae provide accurate information that is accessible to borrowers who need it most. Servicing guide provides information about the process borrowers need to follow to submit a completed FAFSA (Free Application for Federal Student Aid). Servicing Guide to help Fannie Mae understand the impact of the current economic uncertainty and potential changes to the economic climate. Servicing Guide to help Fannie Mae understand the impact of the current economic uncertainty and potential changes to the economic climate.

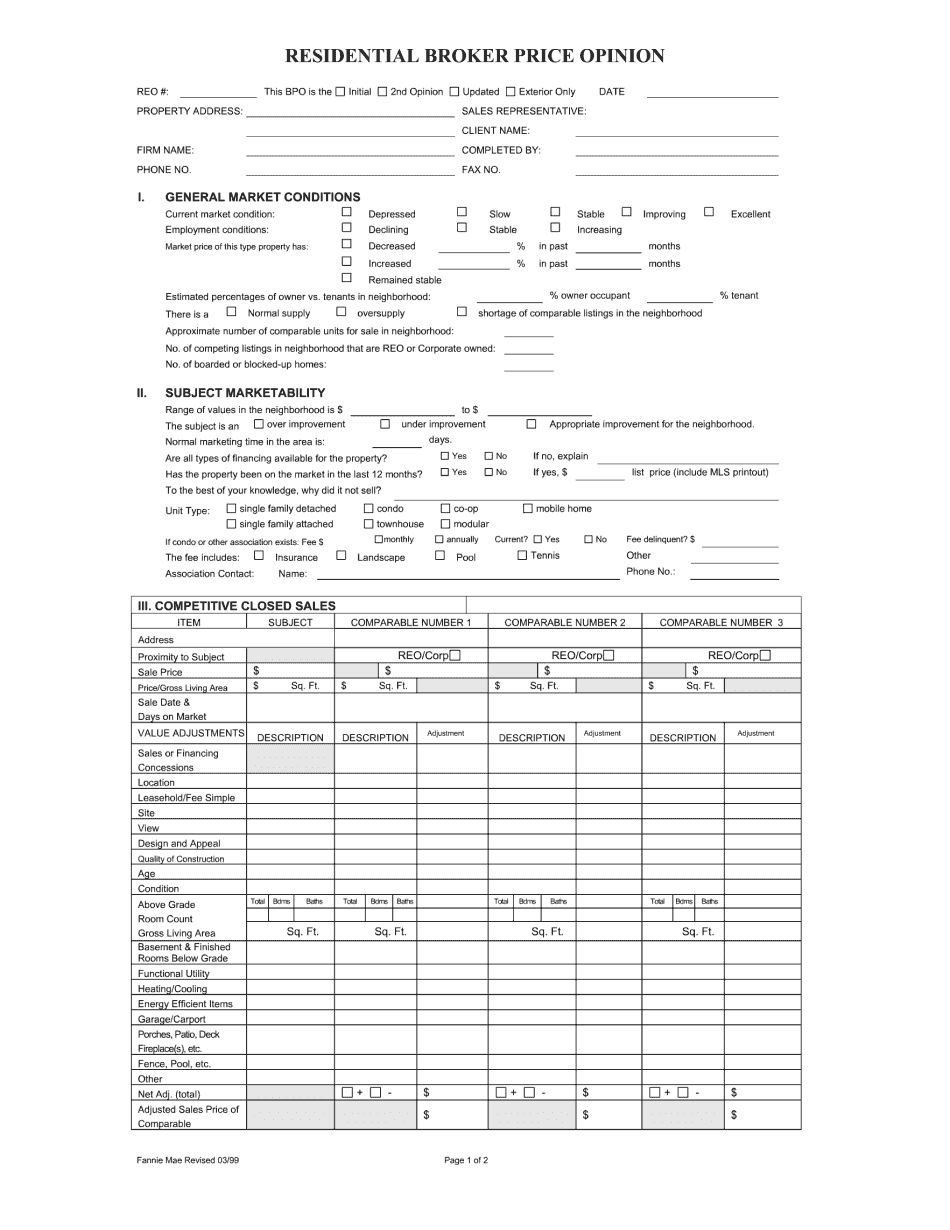

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fannie mae servicing guide