Hey there, this is going to be a quick comparative market analysis. Let me show you how to quickly and easily determine property values. First, you'll need to go to the San decor website or your MLS and log in. Once you're logged in, you'll have access to two tools for conducting a market analysis. The first tool is your MLS Paragon. Go to the search function and select "residential property". For this example, let's search for a property in Rolling Hills branch. Use the address search option and enter the property address. Next, click on the draw button and choose either a radius or a polygon search. In this case, let's use the radius search. Start from the property location and pull out the radius based on the neighborhood size. Generally, I recommend using a half-mile to three-quarters of a mile radius. In this instance, a half-mile should suffice. Now, add the radius search criteria to your search by clicking on "add criteria". After that, you'll need to select the appropriate property statuses. Choose everything that applies, such as active, pending, sold, expired, and off the market. Add these statuses to your search criteria. To determine the time frame for property data, we'll go back six months. This includes off-market properties and those that have recently sold. You can adjust the time frame in the search options. After applying these criteria, you'll notice that there are 57 properties within the half-mile radius. Alternatively, you can refine your search by property style. In this case, we'll choose detached homes and save the changes. After doing so, you'll still see a count of 57 properties, indicating that none of the properties are attached homes. By conducting this MLS search, you will be able to see all the properties that match your criteria in the Rolling Hills branch...

Award-winning PDF software

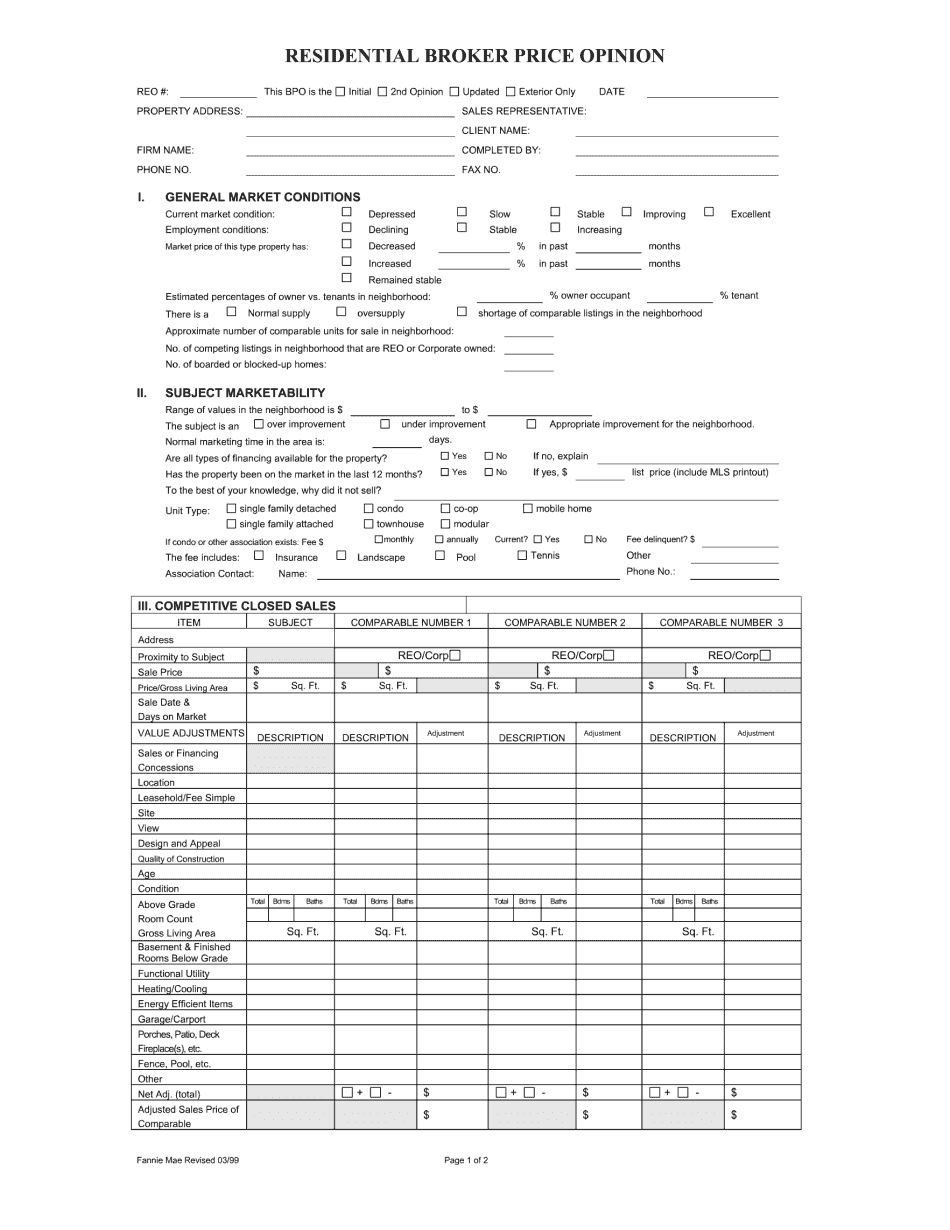

Florida Broker Price Opinion Form: What You Should Know

TPC Requests for Information — IRS Aug 14, 2025 — This IRM provides guidance to Field Collection employees for making third-party contacts in cases where you have 6.31.26 TPC Requests for Information — Internal Revenue Service Dec 10, 2025 — This IRM provides guidance to Field Collection employees for making third-party contacts in tax avoidance cases. Aug 10, 2025 — IRS Field Collection employees should send the Notice or Letter for third-party contact to: TPC Request, 3200 South Capitol Street, P.O. Box 2610, Austin, TX 78 5.10.4 PCs Involving Individuals Other than Taxpayers — Internal Revenue Service You must use this form to authorize the IRS to contact a third party on your behalf or to revoke that authorization for an individual for which the IRS is seeking information. Part 1. Information Return Filed with IRS (You are only authorized to authorize the IRS to contact a third party on Your behalf, not an individual for which the IRS is seeking information. Part 2. Third-Party Contact Request (Required information. Part 3. Authorization/Revocation Request for Information Form (Form 3310-11) (See IRM 5.18.4.3(5)), Part 4. Notice(s) to Third Parties (Form 2635), Section B of Form 3310-11) (See IRM 5.18.3(3), (4), & (3)(d)); Required Information. Part 5. Notice to Individuals Filed with IRS (See IRM 5.18.3.1(5) & (6)) (See IRM 5.18.4.3(4), (5)) Note: See the discussion on third-party contacts in IRC 7203 and IRC 7231. Section B of Form 3310-11 provides formers or recipients the opportunity to request information from the IRS. The specific purpose of the form (e.g., a Notice to Third Parties) and its content (e.g., a statement of the IRS request) are described under section 7203. Notice of tax fraud, fraud by the use of false representation, or information provided by other than a taxpayer (see IRC 7209(10)(a)); Required Information. For tax avoidance cases (see IRM 5.20.7.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida Broker Price Opinion Form