Award-winning PDF software

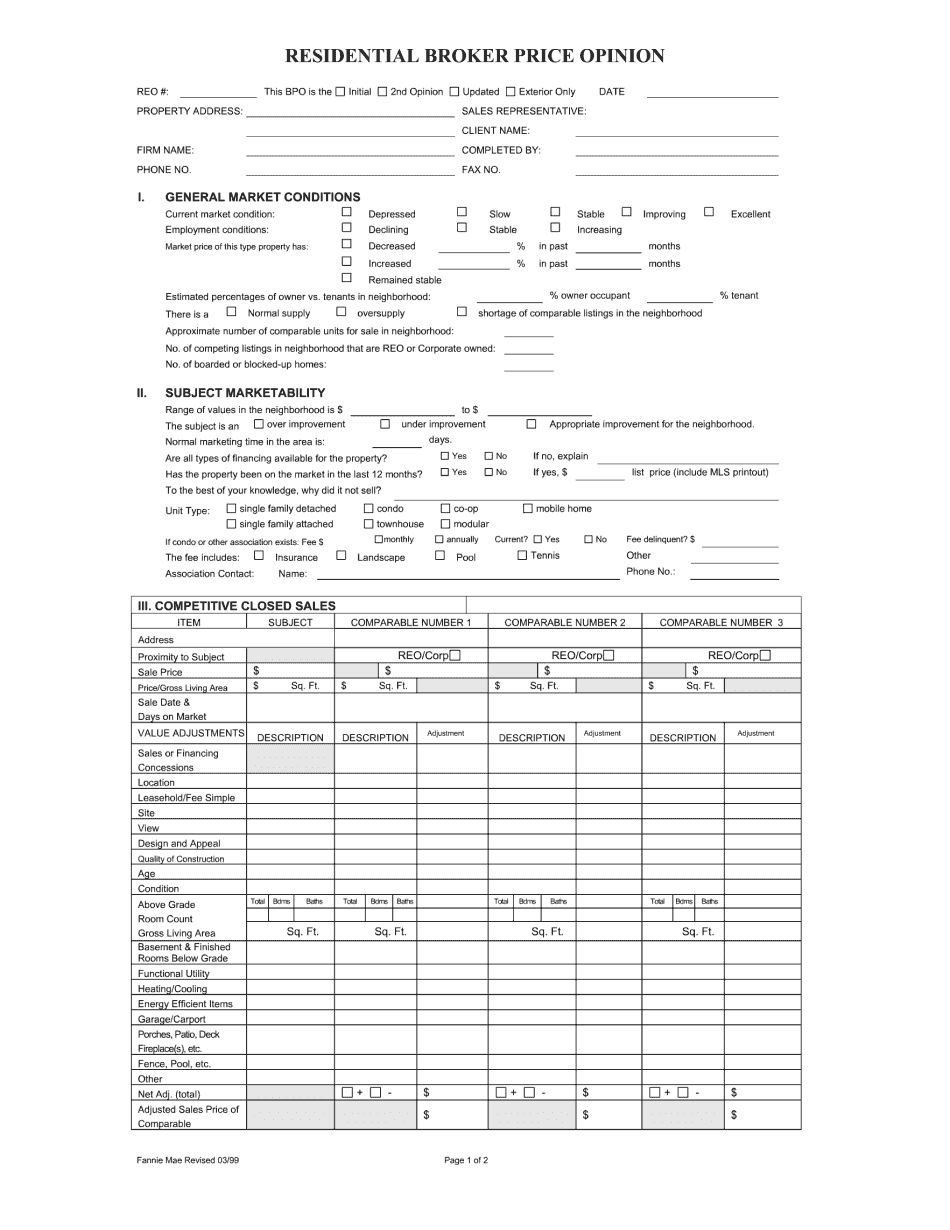

Fannie mae valuation management system Form: What You Should Know

When you make your decision about whether to use the Valuation Management System, you should consider: • If you wish to use the VMS for all of your appraisals: You can save time by reviewing Fannie Mae's valuation management manual. • If you want to use a modified VMS with its own valuation report or a combination of the two: If your VMS requires an appraisal report, download the VMS document format by clicking here. If you want to use a modified VMS and its own report or a combination of the two, you will need to save, load, and upload your current valuation report and create your own valuation documents. If you do not yet have your own appraisal reports, download the VMS document format by clicking here. If you need help creating your own documents, contact your appraiser or Fannie Mae appraisal advisor at your local office. In addition to reviewing Fannie Mae's valuation management manual, you should also review the following resources: • For information about Fannie Mae's appraisers, go to Fannie Mae.com. • For information about Fannie Mae's loan documents, go to Fannie Mae • For information about loan documents, go to Fannie Mae has developed a valuation model that provides guidance on how to handle valuation problems and provides guidance on the use and maintenance of an appraisal report. To develop the valuation model, we collected many typical appraisals from a variety of sources, including appraisal manuals, appraisal reports, valuations that have been posted in the Fannie Mae website, appraisal questions posted on Fannie Mae's bulletin board, and information from our own appraiser network on a variety of topics, including valuation issues. The model uses a standard formula that describes the range of fair market values that an appraiser would expect if the situation were to unfold exactly as appraisers imagine it might without an appraisal. This is a very complex process and requires multiple appraisals. After applying the model, some services use it, or they may choose to use a modified valuation approach based on our analysis. The model provides one set of rules in a standardized format that allows you to compare approaches. We also have developed several valuation reports. Each report describes how we evaluated the same situation, but provides information on a variety of topics. For information about appraisals and reports, visit the home page of Fannie Mae's appraisal department at mortgages.Fannie.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fannie Mae Bpo, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fannie Mae Bpo online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fannie Mae Bpo by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fannie Mae Bpo from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.